Summary for Decision-Makers

Finance leaders don’t just need more software — they need control, visibility, and compliance that generic SaaS rarely delivers.

Custom financial systems reduce recurring license costs, automate high-effort workflows (such as close, reconciliation, and reporting), and enhance audit readiness — often achieving an ROI in 12–24 months.

Built as modular, cloud-ready platforms with role-based controls and deep ERP/BI integrations, they replace fragmented stacks with one source of truth.

The takeaway: if your finance team is juggling multiple tools, rising OpEx, and compliance risks, a purpose-built platform is the most direct path to lower TCO, faster decision-making, and sustainable scale.

In 2025, over 78% of internet users globally use at least one fintech service monthly, and fintech adoption in the U.S. has reached 74% in Q1 2025. This shows that digital finance has become a baseline expectation. Yet behind the sleek consumer interfaces, many internal finance teams still operate on rigid SaaS platforms or legacy systems that limit visibility and escalate costs.

According to Auxis, 45% of CFOs listed investing in technology to reduce operational costs as their top priority for 2025. However, many finance leaders admit they still lack clarity on the true ROI of their tech stack due to fragmented tooling and misaligned metrics.

Therefore, from a financial leadership standpoint, that’s a strategic risk.

As compliance complexity rises, margins tighten, and real-time reporting becomes non-negotiable, finance teams must ask:

Are your current finance tools helping you reduce costs or quietly increasing them?

As a result, that’s where custom financial software development comes in. Tailored to your unique workflows, compliance mandates, and integration needs, it delivers real operational control and measurable ROI, often within 12–24 months.

👉 Related Reading: Custom Software ROI: Why It Pays Off in 12–24 Months

In this article, we’ll explore how financial software development impacts ROI from cost savings and risk mitigation to faster reporting and stronger compliance. Additionally, you’ll also find real-world use cases, investment frameworks, and decision criteria designed for finance teams ready to scale with purpose.

What Is Financial Software Development?

In a digital-first financial environment, operational agility often depends on how well your software reflects the way your business actually works. Simply put, financial software development is the process of building tailored digital tools that match the way your finance team actually works, going beyond basic accounting software.

Unlike off-the-shelf platforms, these solutions are built from scratch to meet your organization's unique needs around:

Workflow-specific automation (e.g., multi-step approvals, entity-based controls)

Audit-compliant reporting structures

Integration with existing ERP, BI, or treasury systems

Role-based access, version tracking, and data tracking history

Complex multi-entity, multi-currency consolidation

From a technical lens, a CTO’s perspective, this means full ownership over architecture, stack, and scalability.

Meanwhile, from a CFO’s perspective, it means cost visibility, compliance control, and faster close cycles.

Learn how Titani Solutions develops financial systems aligned with real-world enterprise constraints and ROI expectations.

A Modular Approach to Finance Technology

Custom-built finance systems typically follow a modular design, allowing teams to scale functionality in phases. For instance, this could include:

Core financial engine: Custom general ledger, AP/AR logic, and budgeting modules

User-facing portals: Internal dashboards, approval workflows, vendor or client access

This modularity not only reduces time-to-value but also helps minimize scope creep, a common risk in large SaaS migration projects.

Designed for Long-Term Control

Strategically, financial software development is less about “adding features” and more about building a platform for control:

Control over compliance implementation

Control over integration limits

Control over cost exposure and stuck with one provider

When built with the right partner and internal alignment, custom finance systems can support 5–10 year roadmaps, eliminating the need for constant re-platforming and workarounds.

In the next section, we’ll examine the cost structure and ROI levers that make this approach financially viable and often superior to long-term SaaS subscriptions.

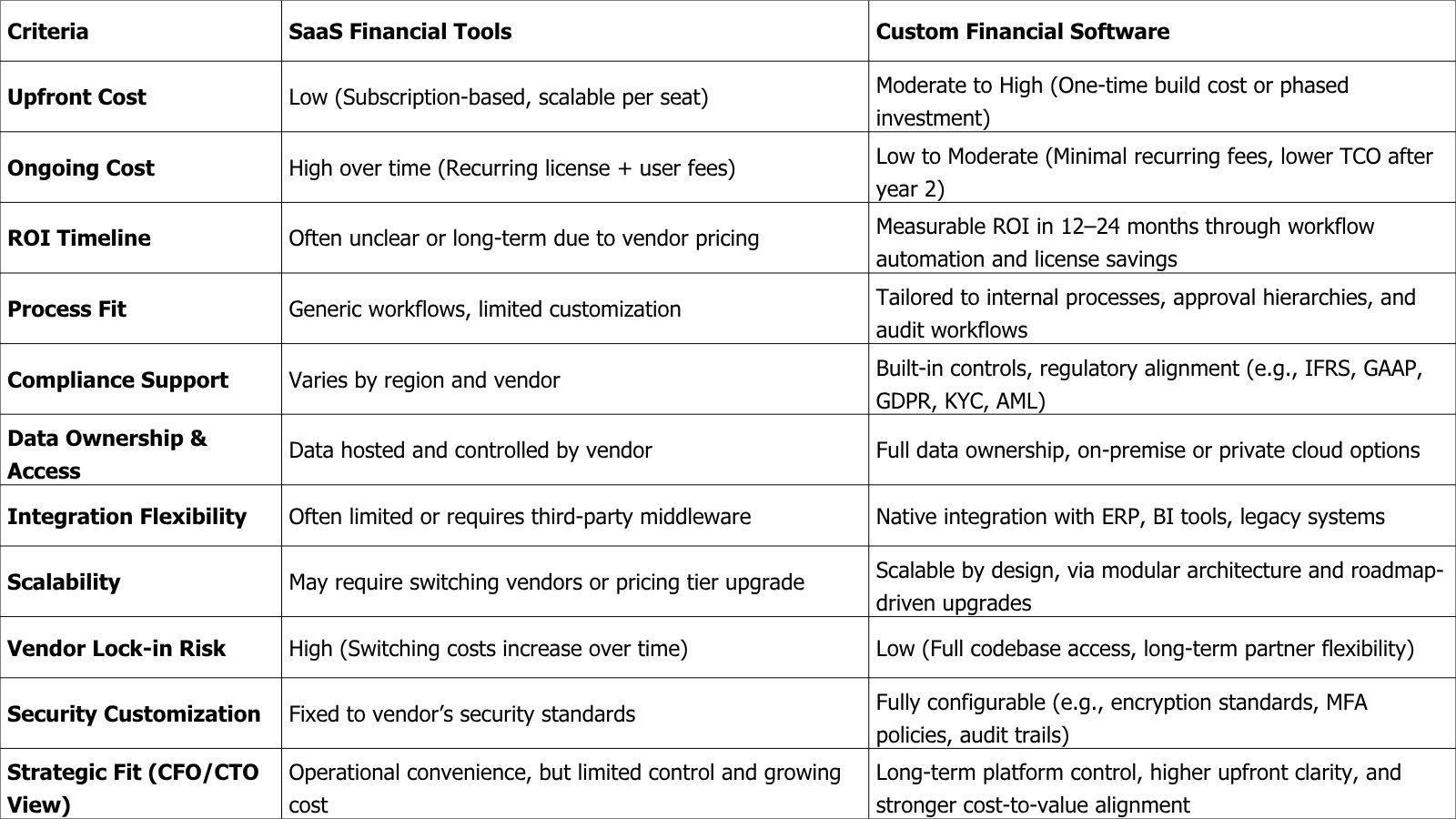

Custom Financial Software vs SaaS: Strategic Comparison

When finance leaders plan their next technology move, the real question isn’t just “What’s faster?” but “What’s sustainable?”

SaaS platforms can seem like the obvious answer: they’re quick to deploy, relatively low-cost upfront, and come with prebuilt features. But that speed often comes at the expense of deeper control over data, costs, integrations, and long-term adaptability.

Custom financial software, on the other hand, takes more commitment at the start. But in return, it gives your team something SaaS rarely does: systems that actually fit how your finance function works, from workflow-specific controls to audit-aligned reporting, all built to scale with you.

Here’s a side-by-side comparison of both options across the criteria that matter most to finance leaders, from compliance and cost structure to data ownership and scalability.

The ROI Equation — Why Custom Beats Off-the-Shelf

When evaluating software investments, ROI is no longer a long-term abstraction; it's a board-level metric. Yet many finance leaders still struggle to quantify returns from their SaaS stack. Licensing fees increase year over year. Integrations remain half-finished. Reporting cycles don’t accelerate. Moreover, workflow gaps persist.

From a financial perspective, that’s an inefficient asset, not an investment.

Instead, custom financial software flips that equation. By aligning directly with your internal workflows and reducing long-term operating costs, well-executed custom systems often reach breakeven within 12–24 months and continue delivering returns for 5–10 years.

Breaking Down the ROI Drivers

So, what drives these returns? Three core levers separate custom software from SaaS in financial impact:

1. Reduction in Recurring Costs

Eliminate annual license escalations across multiple tools

Avoid costly per-seat pricing models as teams scale

As a result, save 20–40% in total cost of ownership after year 2

2. Operational Efficiency Gains

Automate manual reconciliation, close, and reporting tasks

Reduce hand-offs and rework across AP/AR, compliance, and FP&A

Consequently, free up 10–20 hours/month per analyst through tailored workflows

3. Improved Decision Accuracy & Speed

Real-time dashboards built around KPIs your CFO actually tracks

Tighter integration with ERP, CRM, and data warehouses

Faster monthly close, better audit readiness, and reduced error rates

👉 Related Reading: Off-the-Shelf vs Custom Software: Which Is Better?

Understanding the Payback Window

Across our enterprise finance clients, we typically observe:

These results aren’t just theoretical; they come from systems designed around how your business actually works, not a generic product roadmap.

Key Benefits for Finance Teams & Executives

For CFOs: ROI Clarity and Cost Control

Custom financial software isn't just a line item in your CapEx; it's a long-term cost control strategy. For CFOs tasked with managing escalating license fees, fragmented tooling, and uncertain ROI, custom development offers a more predictable and transparent financial path.

By replacing overlapping SaaS platforms with a unified, purpose-built system, finance leaders gain:

1. Cost Visibility Across the Stack

Eliminate vendor sprawl and bundled license agreements that obscure real per-user or per-feature costs

Shift from variable OpEx (subscription) to a fixed-cost, amortized CapEx model

Forecast the 3–5 year total cost of ownership with greater accuracy

2. Faster Payback, Higher Utilization

Build only what your team actually needs — no 60% unused features

Prioritize automation in high-cost processes: reconciliation, reporting, and month-end close

Typical ROI realization in 12–18 months, driven by reduced rework and license consolidation

3. Audit-Ready by Design

Align controls and reporting structure with IFRS, GAAP, or regional tax standards

Real-time audit trail implementation, not workaround retrofits

Lower audit prep time, higher first-pass success rates

For CTOs and CIOs: Platform Control, Architecture, and Security

For technology executives, custom financial software offers more than just functionality; it’s a way to regain control over a tech stack increasingly burdened by integration debt, stuck with one provider, and security compromises. Given that finance systems touch everything from ERP to audit logs, the architectural stakes are high.

With custom development, you can architect a platform that is scalable and governed by your standards, not your vendor’s limitations.

1. Own the Architecture, Not Just the Output

Design modular systems that align with your enterprise integration strategy (e.g., microservices, event-driven, API-first)

Choose your preferred tech stack, cloud provider, and deployment model (e.g., containerized, hybrid cloud, on-prem)

Avoid technical bloat from adapting to third-party platform constraints

2. Security Standards You Control

Build compliance into the foundation, not as an afterthought

Implement enterprise-grade IAM, MFA, encryption, and anomaly detection tied to your internal protocols

Reduce breach surfaces by eliminating generic features you don’t use

3. Tighter Integration, Better Governance

Eliminate fragile middleware between SaaS tools and core systems (ERP, BI, treasury)

Standardize data tracking history, access roles, and audit logs across the stack

Simplify DevOps: CI/CD pipelines, cloud monitoring, and rollback policies under one roof

For Product Owners and Transformation Leads: Fit, Agility, and Scaling Strategy

When managing transformation initiatives, the challenge isn’t finding software, it’s finding software that fits. Off-the-shelf platforms often force teams to change how they work to fit the tool, rather than the tool adapting to the business. That misalignment leads to rework, shadow processes, and unmet KPIs.

In contrast, custom financial software offers a way to align product delivery with real operational priorities, while preserving the agility needed to evolve.

1. Precision Fit with Business Logic

Define features and flows based on actual business rules, not the vendor’s roadmap

Build tools that reflect how approvals, budgeting, forecasting, and reconciliation work in your environment

Remove the overhead of training teams to work around a generic system

2. Iterate Based on Measurable Value

Launch as a Minimum Viable Platform (MVP), then expand features based on usage and stakeholder feedback

Track ROI per release, not just at project close

Eliminate deadweight features, focusing only on what drives adoption and automation

3. Scales with You — Not Ahead of You

Add new entities, currencies, or regulatory requirements as needed

Modularize backend and reporting layers to handle regional expansion, M&A, or shared service centers

Maintain a product roadmap aligned to finance strategy, not just IT resourcing

Common Use Cases of Custom Financial Software

Not every finance team needs a custom-built solution, but for those facing complexity, scale, or compliance pressure, the business case becomes increasingly clear. Custom financial software shines in environments where off-the-shelf platforms fall short due to rigid workflows, multi-entity structures, or deep integration needs.

Below are some of the most common high-impact use cases where custom systems deliver measurable ROI:

1. Multi-Entity, Multi-Currency Consolidation

Managing financial operations across multiple legal entities, geographies, or currencies often pushes SaaS platforms beyond their limits. With a custom solution:

Consolidation logic is aligned to your internal hierarchy and GAAP/IFRS rules

FX rates, intercompany eliminations, and reporting periods are fully configurable

Month-end close is shortened by automating complex rollups and validations

Who benefits: CFOs in holding companies, global finance heads, regional controllers

2. Automated AP/AR Workflows with Embedded Controls

Generic AP/AR systems often leave gaps in approvals, exceptions, and auditability. Custom finance systems allow:

Configurable approval workflows tied to business units, thresholds, and vendor risk tiers

Embedded business logic (e.g., payment hold rules, dynamic discounting, invoice matching)

Full audit trail visibility from invoice ingestion to reconciliation

Who benefits: Heads of Accounts Payable, Internal Audit, Compliance Officers

3. Integrated Financial Reporting and Real-Time Dashboards

When financial reporting depends on spreadsheet patchwork or delayed exports, decision-making suffers. A custom-built reporting layer enables:

Role-based dashboards with drill-down views by business unit, region, or product line

Native integrations with your ERP, CRM, or data warehouse, no ETL workarounds

Real-time variance analysis and forecasting tools tied to live data streams

Who benefits: FP&A teams, Executive Finance, Board Reporting Analysts

4. Built-In Compliance Frameworks and Regional Regulations

Finance software that doesn’t adapt to changing regulatory needs becomes a liability. Custom solutions support:

Automated KYC/AML workflows for financial services use cases

Built-in compliance checks for SOX, GDPR, VAT, e-invoicing, or country-specific formats

Streamlined audit preparation with standardized, traceable reports

Who benefits: CIOs, Legal/Compliance, Finance in regulated sectors (e.g., fintech, logistics, healthcare)

When Should You Consider Custom Financial Software?

Custom development isn’t the right move for every finance team. Still, for organizations facing scale, complexity, or regulatory exposure, the cost of continuing with generic tools may quietly outweigh the cost of building the right solution.

Here are the clearest signals that your team has outgrown off-the-shelf software and that it may be time to consider custom.

1. Your Finance Stack Has Become a Patchwork

If your month-end close requires manual hand-offs between four different tools — AP in one, GL in another, reporting in Excel, and compliance tracked via email, you’re not just dealing with inefficiency. More importantly, you're exposing the business to operational risk, audit failure, and missed deadlines.

Custom software allows you to consolidate workflows into a single, integrated platform with shared controls, eliminating costly context-switching and spreadsheet glue.

2. You’re Paying More, But Getting Less Value

Rising SaaS subscription costs are often easy to approve in isolation, until you map them across the enterprise. In many finance teams, only 40–60% of purchased features are actively used, while license fees continue to scale with headcount.

Custom solutions focus only on the features that drive ROI, with no hidden costs for users you don’t need or modules you don’t use.

3. You Need Full Control over Compliance, Data, or Architecture

If you’re in a regulated industry, operate across borders, or manage sensitive internal workflows (e.g., multi-entity transfers, treasury ops), lack of system control becomes a liability. SaaS tools may delay rollout of compliance updates or worse, push you into workarounds.

Custom development gives your team full ownership over how data is stored, who accesses it, and how compliance is enforced, proactively.

4. You’re Scaling into Complexity — Not Just Headcount

Growth doesn’t just mean more users. Often, it means more legal entities, business units, SKUs, and tax rules. That kind of complexity strains rigid SaaS models.

A modular, custom system grows with your finance operation — not ahead of or behind it.

A Quick Decision Checklist:

If you answer yes to 3 or more of the following, it’s likely time to explore a custom path:

Are you managing more than 3 legal entities across regions or currencies?

Do your teams rely on Excel to bridge gaps between core systems?

Is compliance handled outside your main platforms?

Are annual SaaS costs growing faster than your finance headcount?

Do you lack visibility into end-to-end reporting or audit trail integrity?

How to Start: From Discovery to Development

1. Start With Discovery — Not Features

For most finance leaders, building custom software isn’t a question of feasibility; it’s a question of clarity. The real challenge isn’t technical; it’s strategic. What should we build first? What pain point delivers the most immediate return? What’s the actual risk of doing nothing?

The smartest teams don’t begin with features or frameworks. They start with a discovery sprint, a structured exercise that maps internal workflows, surfaces inefficiencies, and reframes business objectives into software logic. At this stage, the conversation shifts from “What should we build?” to “What outcome are we optimizing for?”

At Titani, we approach discovery like financial modeling, a way to quantify current loss, define future value, and align everyone on what a successful platform needs to accomplish.

2. Use Business Outcomes to Shape Your MVP

Instead of aiming for a feature-complete system out of the gate, leading teams focus on a Minimum Viable Platform, one that solves a real problem, fast.

This could mean automating manual reconciliation, enforcing approval logic for AP/AR, or eliminating spreadsheet-based reporting. Whatever the case, the goal is to ship something measurable within weeks, not months. These early wins create momentum and free up budget for iterative expansion.

With a modular foundation, the platform can evolve over time, adding dashboards, compliance workflows, or integrations, without rewriting core components.

3. Validate Assumptions Early

In finance, assumptions are expensive. That’s why top-performing teams validate feasibility before committing to full development. This can take the form of:

Interactive wireframes to align stakeholders

Small-scale integrations with your ERP or BI system

A proof-of-concept that confirms edge cases and data flows

This step doesn't just reduce technical risk; it increases stakeholder confidence and sharpens the business case.

Choose the Right Partner — Not Just a Developer

Custom finance systems live at the intersection of technology, compliance, and business operations. You don’t just need engineers, you need a strategic partner who understands how to encode accounting logic, audit trails, approval workflows, and integration limits into a resilient platform.

A good partner will challenge your assumptions, help you prioritize, and design for scale. A great one will make your team smarter, not just faster.

Want a blueprint? Titani Solutions offers Discovery Sprints that help CFOs and CTOs define scope, validate feasibility, and model ROI before writing a single line of code.

Conclusion: Financial Software Is a Strategic Asset

The future of finance isn’t about adding more tools; it’s about designing systems that give you control, not complexity. In 2025, finance leaders face mounting pressure to deliver real-time insights, ensure audit-readiness, and manage cost exposure, all while navigating fragmented, rigid tech stacks. Traditional SaaS platforms weren’t built for that. Custom financial software is.

At its core, custom development isn’t about writing code. It’s about gaining clarity, clarity over how data flows, who owns it, and how decisions get made at scale.

For CFOs, that translates into clear visibility into ROI, compliance, and financial governance. CTOs gain architectural ownership and the freedom to scale without vendor constraints. And for transformation leaders, it means building platforms that align with how the business operates, not the other way around.

Workarounds vanish. ROI guesswork ends. Spreadsheets stop acting as glue for broken stacks. If your finance team is still adapting to generic tools instead of leading with purpose-built systems, the cost of doing nothing may already be higher than you think.

Titani Solutions helps forward-thinking finance teams build systems that last, from discovery to deployment. Learn how we scope financial software projects around ROI and real use cases. Or connect with us to explore how a tailored platform can help your finance team scale with clarity.